Explain the Different Sources of Long Term Finance

MEDIUM TERM SOURCES OF FINANCE FUNDS. The Examples of Long-term Sources of Finance are-Equity Shares- Equity shares are one of the common examples of Long-term Finance Sources.

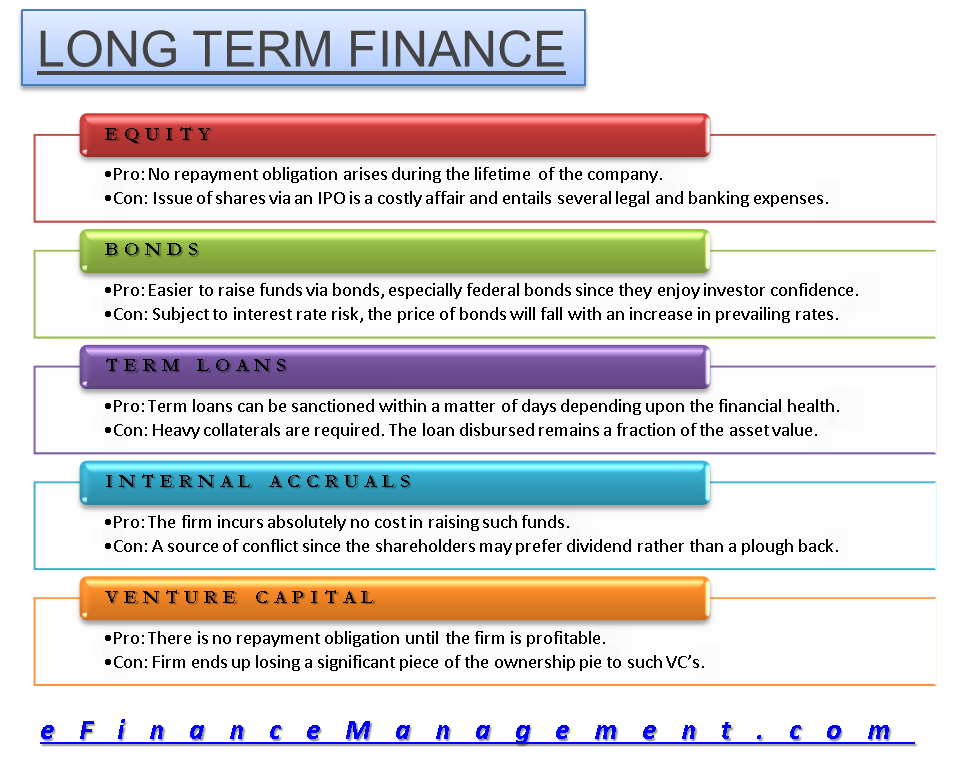

Long Term Finance Equity Bonds Term Loans Internal Accruals Venture

Various types of long-term sources of.

. Based on the exact needs of the business and financial strength of the company you are likely to be better off by going ahead with long term and short term sources of finance. Within the organization or externally ie. The long term financing could be done internally ie.

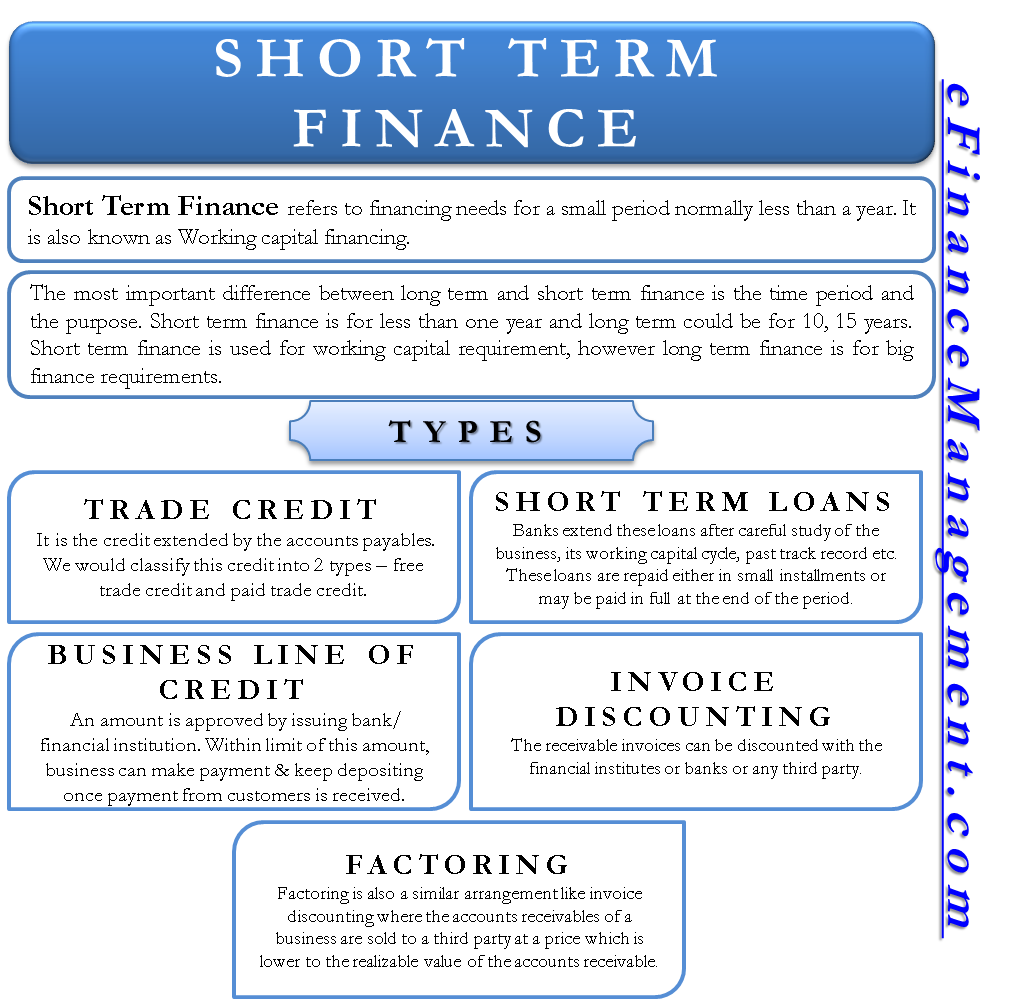

To meet their long term and short term requirements firm needs amounts to meet their requirements. This chapter deals with the major vehicles of both types of financing. The long term and short term sources of finance are typically the most preferred source of financing business over the other options available.

To expand business operations. An ownership source of finance. But in case of companies.

Features of Long-term Sources of Finance It involves financing for fixed capital required for investment in fixed Assets. Long term finance is mainly for companies who need a large sum of money which would be difficult to be paid back this would be used to provide start-up capital to finance the business for its whole lifespan finance the purchase of assets with a longer life such as. From outside the organization.

These are issued to the general public. As stated earlier in case of sole proprietary concerns and partnership firms long-term funds are generally provided by the owners themselves and by the retained profits. Short-term financing is normally used to support the working capital gap of a business whereas the long term is required to finance big projects PPE etc.

Sources of finance shows the mobilization of funds for their requirement. These may be of two types. Features of Equity Shares-.

Involve the public issue of equity and preference shares in the stock exchange. It enables in fulfilling money requirements needed for longer time period. A debenture is a document that either creates or acknowledges a debt and the debt is one without collateral.

Long term medium term and short term. They are also known as the Owners of the Company. It is obtained from Capital market.

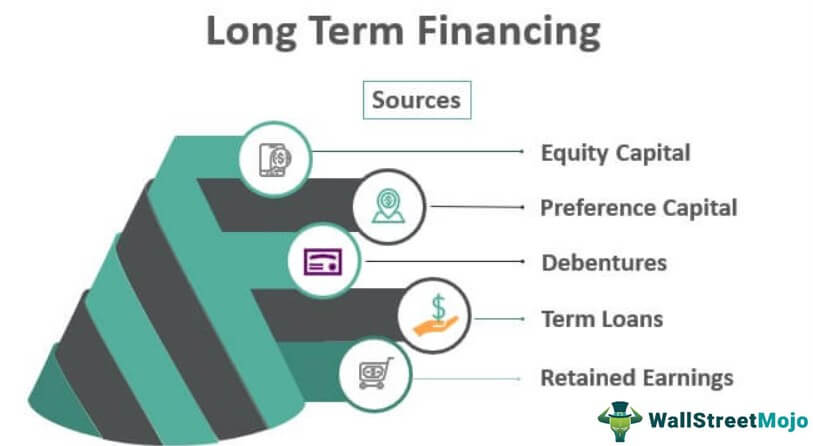

Based on the period. Sources of long term finance The main sources of long term finance are as follows. Issuing shares is the most common method of raising long-term capital because there are various many investors who are ready to invest in the capital market.

Generally used for financing big projects expansion plans increasing production funding operations. The common sources of financing are capital that is generated by the firm itself and sometimes it is capital from external funders which is usually obtained after issuance of new debt and equity. There are different vehicles through which long-term and short-term financing is made available.

Based on mobilization of funds various sources are classified as below. The sources of long-term finance refer to the institutions or agencies from or through which finance for a long period can be procured. The External Sources of Long Term Finance.

Long-term finance generally helps businesses in achieving their long-term strategic goals. The explanation of these sources of funds as shown in Figure-1 is given as follows. The holders of shares are the owners of the business.

Long-Term Sources of Finance. The purposes are totally different for both types of financing. The sources of finance can be split up into three types.

A Issue of Shares. Longterm sources of finance have a long term impact on the business. Fund raised through these instruments can be paid back over many years.

Long-term sources of fund. The Internal Sources of long-term finance. Sources of Finance A.

These Shareholders receive the dividend after giving the payment of interest and dividend to the preference shareholders. Short-term financing is normally for less than a year and long-term could even be for 10 15 or even 20 years. In corporate finance debenture refers to a medium- to long-term debt instrument used by large companies to borrow money.

It may come from different sources such as equity debt hybrid instruments or internally generated retained earnings. These are also issued to the general public. 9 rows LONG TERM SOURCES OF FINANCE FUNDS.

In some countries the term is used interchangeably with bond loan stock or note.

Long Term Financing Definition Top 5 Sources Of Long Term Financing

Short Term Finance Types Sources Vs Long Term Efinancemanagement

Guide To Long Term Financing Definition Here We Discuss The Top 5 Sources Of Long Term Financing Along With Exam Long Term Financing Finance Investing Finance

Comments

Post a Comment